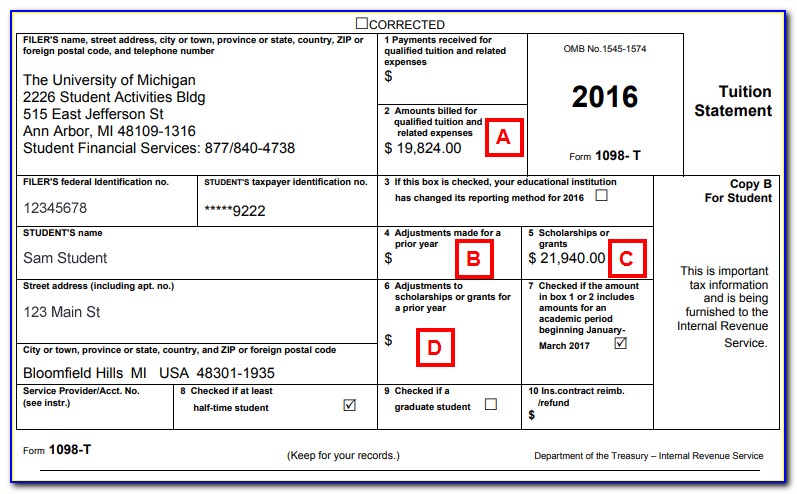

International students must request a form, if needed. The University does not automatically generate 1098-T forms to International Students. A 1098-T Tuition Statement reports qualified tuition payments and financial aid awarded to students enrolled in courses during the calendar year for which they. If you are not a current student and need a copy of your 1098-T, please contact the Bursar at or call (609) 896-5360. Form 1098-T is an information tax document to aid taxpayers in determining whether they are eligible to claim a tax deduction or one of the education tax. You may print the form for your records through your browser. Go to Rider's student portal at and log in.To retrieve a copy of your IRS form 1098-T on the myRider portal: Eligible educational institutions must file a Form 1098-T, Tuition Statement for each student they enroll and for whom a reportable transaction is made. Claiming education tax benefits is a voluntary decision for those who may qualify. There is no IRS requirement that you must claim education credits. There is no need to attach Form 1098-T to your tax return. Due to a change to institutional reporting requirements under federal law, beginning with tax year 2018, we will report in Box 1 the amount of QTRE you paid during the year. The IRS Form 1098-T reports amounts paid of qualified tuition and related expenses, as well as other related information. The institution has to report a form for every student that is currently enrolled and paying qualifying tuition and related expenses.

This form is designed to help families, and their tax preparer, determine their qualification for either the Hope or Lifetime Learning Credit or qualification for a tuition and fees deduction on their annual income tax.įor further details, please visit consult with your tax accountant.ĬHANGE NOTICE: In previous years, Rider University reported your 1098-T based on a figure in Box 2 that represented the qualified tuition and related expenses (QTRE) we billed to your student account for the calendar (tax) year. Form 1098-T, Tuition Statement, is an American IRS tax form filed by eligible education institutions (or those filing on the institutions behalf) to report payments received and payments due from the paying student. The IRS Form 1098-T is a tax information statement required by the Internal Revenue Service (IRS).

0 kommentar(er)

0 kommentar(er)